OpenTax has always brought HMRC data together in one place, making it easier to spot issues and understand what needs attention.

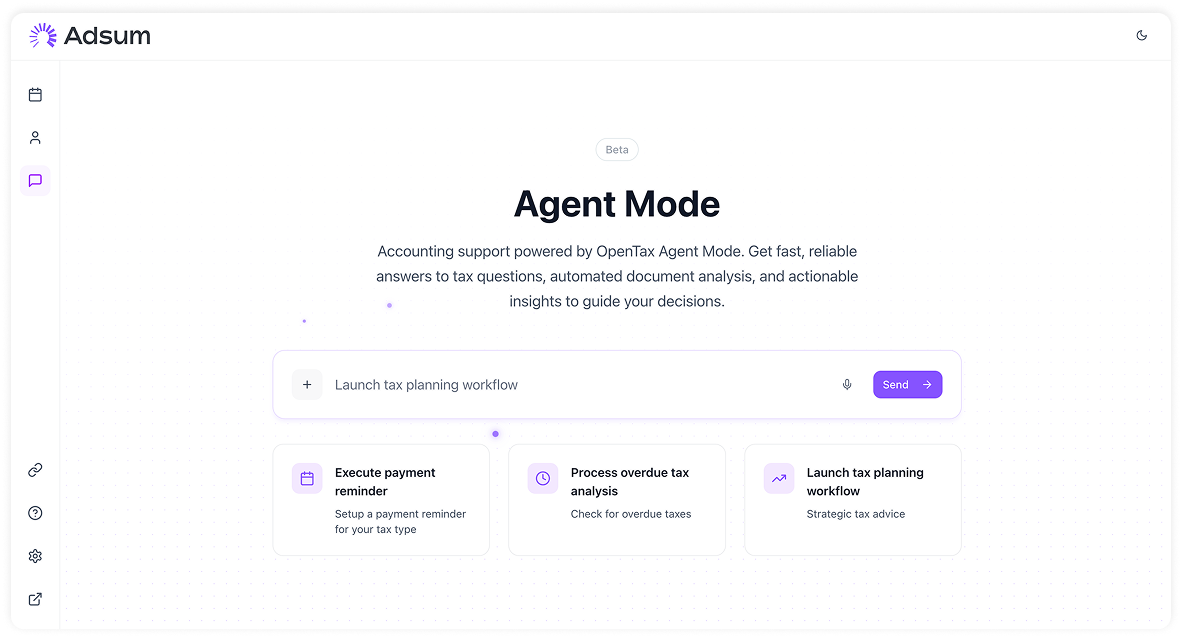

Agent Mode builds on that foundation by taking the next step: not just surfacing problems, but actioning the jobs that resolve them. It’s a natural progression – from consolidation and clarity, to automation and completion.

The next major leap in business technology will be driven by autonomous systems capable of carrying out complex, end-to-end workflows with minimal human input.

This means that entire categories of routine, repetitive work will no longer require human intervention and instead, professionals will orchestrate and utilise technology to handle the execution, while their role shifts toward oversight and strategy.

For accountants, this represents a pivotal moment. The administrative work that has historically consumed so much time chasing filing deadlines, reconciling tax balances, checking client accounts can increasingly be delegated to technology.

The firms that lean into this transformation early will gain a decisive advantage: more time for client relationships, sharper advisory capabilities, and the ability to scale without adding headcount.

This is why the step we’re making with OpenTax Agent is so important. It’s not just a feature release, it’s part of a broader shift, where technology takes on the heavy lifting so professionals can focus on the work that truly matters.

As outlined in “B2B SaaS in 2028: Orchestrating Agents”, the next leap in business technology will be towards autonomous systems carrying out complex workflows. Routine, repetitive tasks will shift to machines, while professionals focus on oversight and strategy.

For accountants, this is a turning point. Tasks like filing, reconciliations, and account checks will be handled by technology, freeing firms to invest more time in client relationships, advisory work, and scaling without extra headcount.

That’s why OpenTax Agent matters. It’s more than a feature – it’s the start of the shift towards technology doing the heavy lifting, leaving professionals to focus on the work that truly counts.

One of our most popular features is our automated payment reminders – reducing missed deadlines and penalties. With Agent Mode, these reminders become even more flexible and tailored to your firm’s needs.

One of our most popular features is our automated payment reminders – reducing missed deadlines and penalties. With Agent Mode, these reminders become even more flexible and tailored to your firm’s needs.